Abstract

Energy Return on Investment (EROI, sometimes EROEI) is one of the most important indices for evaluating the efficacy of a primary energy source. It is generally defined as the relation between the energy extracted from a given resource and the energy costs diverted from society to extract it. In this paper, the EROI of 30 oil companies was calculated using the CO2 emitted by the companies and declared in Sustainability and/or Annual Reports as required by law, to estimate the energy used for the production process over a time span of 20 years (1999–2018). The resulting EROI estimates for the companies analyzed are rather homogeneous and, except in some cases, these values are relatively constant over time. These values agree (although sometimes somewhat lower than) estimates derived by other methods.

Similar content being viewed by others

Introduction

One of the most relevant indexes used to measure the quality of an energy resource is Energy Return on Investment (EROI). Studies in this field are flourishing and this index—the basis of which is well defined in Hall (2017a)—shows to be a robust way to understand what are the global trends in the energy field, especially for the oil and gas sector (e.g., Guilford et al 2011; Hall et al. 2014).

The relevance of the oil and gas sectors to modern economies and indeed civilization is fundamental: as the BP statistical review data shows, for recent years the total amount of petroleum consumption is quite high and, with a dip attributed to Sars-CoV-19, still increasing, with petroleum contributing 67% for 2017 and for 2018. However, knowing what the oil companies' EROI’s values are, is fundamental to understanding how much time we have to accomplish an energy transition to renewables sources (Sers and Victor 2018). This is fundamental, also due to the strong social and scientific pressures linked to climate change and because of eventual oil depletion. The world is still using a large amount of energy that comes from traditional fossil fuels, as shown in the BP data and what the World Bank has called “the Total Natural Resources Rent” (TNRR). The economists have traditionally dismissed the importance of fossil energy to the economy because it is “only” some 5 to 10 percent (or less) of GDP (Aucott and Hall 2014). However, as pointed out in Melgar-Melgar and Hall (2020), energy is critically important to our economy because it is cheap, i.e., you can get a great deal of economic production for very little expenditure relative to labor or capital (Kümmel et al. 2015). As the price of energy rises and falls, it becomes a more or less important component of GDP but at least recently, it is always cheap, if compared to its critical role in economic production.

The World Bank annually edits and updates the TNRRs (Total Natural Resource Rents) of individual countries and on a global scale, measuring this rent as a percentage of GDP. Methodologically, the total includes fossil fuels, minerals and forests, and the rent itself is defined as the differential between the regional price and the cost of extraction. If we overlap the graphical index of the period 1970–2019 to that of the price of oil in the same period, as shown in Fig. 1, they are almost identical. Minerals and forests are "intangible" with respect to fossil fuels; coal has a predominantly local consumption (in 2015 world exports amounted to 19% of production) and the price of gas over time is still very largely dependent on the price of oil as it changes over time.

This data—in addition to geopolitical considerations that go beyond this article—should be sufficient to demonstrate the fundamental importance of oil not only in world economies in a general sense but also in determining the rent (linked to GDP) of other natural resources.

Figure 1 shows the coupling between TNRR and oil prices during the 1970–2019 period.Footnote 1

Graph shows the coupling between the total natural resources rent—expressed in percentage of GDP—and the oil price (World Banka and BP data). aMore precisely what is classified with the code NY.GDP.TOTL.RT.ZS and named “Total natural resources rents (% of GDP)”. The aggregation method, the statistical concept, and the methodology are explained on the page https://databank.worldbank.org/metadataglossary/adjusted-net-savings/series/NY.GDP.TOTL.RT.ZS

The recent Sars-CoV-19 pandemic has shown how different the vision can be between an economic point of view and a biophysical point of view as also Habib et al. (2020) and Albulescu (2020) have shown. During the global lockdown, with a worldwide economy frozen, the oil price—I take Brent as an example—fell, in April 2020, to 18.47 $/barrel (source: Europe Spot Brent Price crude oil), with an average decrease of − 34% compared to the previous year (the average values of the prices went from 64.35 $/barrel to 41.70 $/barrel). In April 2020 some media headlines their articles as follows: US Oil Prices Fall below Zero for the First Time in History, with the two lines of explanation that cannot be more eloquent: "Oil prices went into negative territory on Monday. That means traders were paying money to get people to accept oil in May. It's a sign of just how imbalanced the global oil markets are". This, as we can well guess, has nothing to do with the biophysical aspect of the oil, which, if it is not extracted or sold, does not affect the quantity available. More generally, Hall (2017b) describes the need to distinguish the biophysical aspects of EROI measurement from the economic ones.

The first generally accessible study on the EROEI of fossil fuels was Cleveland et al. (1984), which used official US government data on industrial energy production to estimate the energy gained and required for US oil production. That study used official US data on the energy used directly for different industries and the energy used off-site to generate equipment used on-site. The latter was derived from an economic analysis of monetary expenditure by sector and an energy intensity factor, as outlined in Murphy and Hall (2011). Data derived from this method are summarized in Murphy et al. (2011) and Hall et al. (2014).

Our calculation method is an alternative approach, fits between these and, as demonstrated in Celi et al. (2018), the values are sufficiently homogeneous with those determined by other methods.

Methods

The calculation method, already described in Celi et al. (2018), is possible because oil companies declare a certain amount of CO2 emissions for their oil and gas production. If we imagine "burning" all the oil produced, we get a certain amount of CO2, which was used as the numerator of the EROI index. Having available the CO2 emissions that are given for that production, that value can be put in the denominator. Then the CO2 volumes of the product and the incoming fuel was used to determine the energy used by the EROI of the oil companies, which is called EROIINC, given as a ratio:

where CO2prod is the oil production in CO2 equivalent and CO2emiss denotes the emissions, always in CO2, to obtain that production. First, the volume of CO2 released when the company's oil production is eventually burned was calculated. This will be the numerator of our energy performance ratio. To make this calculation, we note that the basic oxidation reaction that produces carbon dioxide during the combustion of fossil fuels is as follows:

For the sake of simplicity, we further assume that oil is a collection of (–CH2–) molecular units, i.e., that the main contribution to CO2 production comes from oxidation of (–CH2–) monomers, while that due to other sources (–CH3 groups, aromatic units, etc.) provides only a minor correction to the whole CO2 production. Therefore, multiplying the weight of the yearly oil production of a company by the ratio between the molecular weights (MW) of CO2 and –CH2–, i.e.,

We obtain the CO2 quantity corresponding to the production. This number will provide the numerator of the EROIINC in Eq. 1. The denominator of the EROI, the CO2 equivalent emissions due to the oil and gas production, was derived directly from the Sustainability Reports (SR), which often report it as data. For the conversion between barrels of oil and the corresponding weight in kg, it is necessary to know the oil density rho (ρ).

For this purpose, we take the average worldwide valueFootnote 2 of ρ = 863 kg/m3. This assumes that oil is a globally homogeneous chemical (or at least that it is the same mix for all companies) mixture with the same composition and properties, namely containing the same mixture of hydrocarbons. This approximation is consistent with the generally accepted use of international oil statistics, to report the sum of the volumes of different categories of oil (crude and condensate, NGL, light tight oil, etc.) and, for our purpose, gas.

I derive the ratio of oil to gas production directly from the Sustainability Reports (SR) or/and Annual Reports (AR) published by oil companies as a data source. In these reports, there is often a lack of differentiation between oil and gas production data, often indicated in BOE (barrels of oil equivalent)—both for oil and gas production—and more rarely in BTU or other measurements units. What we found in the SRs, dividing oil and gas, is a prevalence of oil production (67% of the total quantity for the companies analyzed) compared to gas (33%), with respect to global production. These percentages are slightly different if compared with the BP Statistical Report which, for the entire worldwide hydrocarbon production estimates the division between 59% of oil production and 41% of gas (always considering the 100% the total amount of production). This because the analyzed companies do not constitute 100% of world production, but about 60%, with fluctuations that vary from year to year, as we can see in Fig. 3.

Another potential margin of uncertainty is linked to emissions (which go to the denominator of the EROI). I am almost certain that those declared in the company reports are in fact direct emissions—therefore linked to production (and some more virtuous companies distinguish between direct and indirect). What somehow guarantees the quality of the data is, in this sense, their low variability: the data provided by the companies is relatively constant from year to year.

This approximation is inevitable for deriving corporate EROI using this method. Its potential importance was examined for the results in the later section on sensitivity analysis. The correction of the final value of the EROI in most cases is less than one percentage point, which is not significant for this analysis.

However, the differentiation between oil and gas for this calculation ultimately leads to a correction of the final value of the EROI in many cases of less than one point, which, for the purposes of this estimate (which is also qualitative), does not make sense to establish. In particular, this correction of the EROI values, due to a different quantity of emissions for the production of oil and gas, led to lower values—compared to the previous ones without corrections—of less than 10%. Only in the case of four companies, with a prevalence of gas production compared to oil, at higher values, but always with values below 10%.

To summarize, the numerator was calculated starting from the oil and gas production values reported in the company reports (AR or/and SR) in BOE, which was then converted into energy units (petajoules, PJ). The denominator was calculated with a double-conversion:

-

the first, by converting the CO2 release values derived from the emissions declared by the companies (again in the AR or/and SR) to the corresponding energy (to generate those emissions), in BOE;

-

the second, converting, as for the numerator, this energy into PJ.

In Appendix I, for each of these companies, the data source and, where it was possible, how I made up the lack of data have been briefly described.

A Calculation Example

The CO2 reporting allows us to derive the denominator of the EROI equation, and production statistics (in barrels of oil and cubic meters of gas) allows us to calculate the numerator, the only problem being different units. CO2 was converted to energy as BOE, or barrels and cubic meters to BOE or Joules or CO2, or everything to Joules or everything to CO2 as long as the units are the same and proportional to the energy produced and used. I have chosen to convert both CO2 and barrels of oil to energy for the equation as follows, choosing, among the Sustainability Reports available, one of the clearest—the Shell reports—which we use here as an illustrative example. Shell oil production in 2015 was:

3 × 106 [barrels/day], corresponding to a total mass of oil of:

Moil = 3 × 106 [barrels/day] × 365 [days/year] = 1 095 × 106 [barrels/year].

This value must be converted into energy: we know that 1 barrel of oil contains on average 6.118 × 109 J and therefore Shell's annual production for 2015 amounts to approximately 6 700 PJ. This value constitutes the numerator of our calculation.

For the denominator we must instead perform the inverse calculation because we have the value of the CO2 emissions necessary for the production of oil and gas.

The question we must answer is therefore: how much energy does 68 million tons of CO2 equivalent correspond to (data taken from the Shell Sustainability Report for 2015)? We calculated the value of the average density of oil ρ = 863 kg/m3; we also know that a barrel of oil is about 159 L or 0.159 m3 and finally we know from [3] that the ratio between the molecular weights between CO2 and CH2 is 3.14. This allows us to trace the amount of oil equivalent, at least in theory, to the emissions supplied by Shell, namely:

At this point, we just have to multiply this last result by the value of the denominator, which allows us to have the corresponding Joules:

Shell's EROI for 2015 is therefore: 6,700/960 ≈ 7:1.

Where do the Emissions Come From?

I continue to use Shell as a useful example to describe the genesis of emissions expressed in a single number by companies. Shell helps us because in the latest reports it has broken down its emissions by country and by source. In the graphs below (Fig. 2a, b) we report these subdivisions for the five-year period 2016–2020.

Boundaries of the Analysis

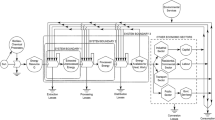

A key aspect to compute correctly the EROI is to determine, as described in Murphy et al. (2011), the boundaries of the observed system. In this specific case, it is a question of understanding what we consider in the calculation of the energy invested in the denominator. Murphy et al. (2011) offer excellent indications for practically orienting oneself in this type of calculation and certainly, accepting their methodological invitation 10 years later, we can say that the boundary of the system we are considering is the one that includes the three levels described in Fig. 1 of their article:

-

level 1: energy extracted and not processed;

-

level 2: processed (/ refined) energy;

-

level 3: energy available for work, heating, etc. (therefore available to society as a whole).

The reality of world oil companies, as already seen in Celi et al. (2018), is very complex: there are private multinationals that work all over the world, not knowing state borders; there are state-owned companies that make up the GDP of an entire nation and, in between, there are a thousand other companies that extract but also refines petroleum products, while others do practically only refining services or other petroleum by-products. It is practically impossible to provide homogeneity criteria and therefore the method basically consisted in treating the companies themselves as black boxes and basing the calculations only on what they themselves declare in their reports. All this without counting the economic-financial aspects that we have deliberately left aside in this discussion: in 20 years there have been mergers, mergers, acquisitions, and state-owned companies that have almost gone bankrupt following civil wars, as in Venezuela. It was, therefore, necessary to make some drastic choices in order to make comparisons: the boundaries are those described—which coincide with what the company claims to do within its gates—and the data is simply oil/gas production and the emissions corresponding to these productions.

Results

The average EROI for the 30 companies from 1999–2018 is almost a constantly 11 (± 1):1. When those EROI values are weighed by the oil production of the company under consideration the mean value is about 10 (± 1):1, indicating that larger producers tend to have lower EROIs (Fig. 3). There is no clear change over time, although a tendency for some companies to decrease slightly (Appendix). The EROI values and the trends over the twenty years are exceptionally stable. Half of the 30 companies examined have an average EROI, in the 20 years examined, of less than 10:1. 12 companies have an EROI between 10:1 and 15:1 and only 3 between 15:1 and 20:1. None has an average EROI greater than 20:1 (Fig. 4).

EROI value calculated for the 30 companies examined, both with a simple mean (in green) and with a weighted mean (in blue). The percentage (red line, “reliability”) indicates, from year to year, how representative this EROI value is with respect to world oil production, i.e., the share indicated by the sum of the production of all the companies analyzed with respect to the total for that year, obtained from the BP Statistical Review

The result of Fig. 3 arises from the EROI values calculated on the 30 companies analyzed, as shown in Fig. 4 and as described in more detail for each individual company in the appendix.

Discussion

One of the striking aspects of this analysis lies in the fact that many very large western "historical" companies such as Shell and BP have low EROI values throughout the twenty years under examination. This aspect seems not to be linked to particular factors: if we take for example Shell, a company among the most transparent and which offers a lot of information on its activities, we notice that its EROI makes a small leap between 2015 and 2016, going from 6.8 to 8.6.

Behind this increase seems to be the acquisition of the BG Group by Shell, for an investment of 53 billion dollars.

Despite this, the EROI of the company does not change radically. Then it may be useful to check another parameter: the production costs.

Production Costs Analysis

Many factors that affect oil and gas production costs and IEA (2013) makes a brief summary that is worth reporting:

-

the resource category to be exploited, which defines the necessary infrastructure and production processes, e.g., large conventional oilfields, deepwater developments, energy-intensive steam-assisted gravity drainage processes for in situ oil-sands production, the high well costs for tight gas, the depth and thickness of coal seams or coal-to-liquids (CTL) conversion;

-

location of the reservoir, e.g., onshore or near-shore reservoirs versus ultra-deepwater offshore or Arctic fields and distance of coal reserves to the power station or the export terminal;

-

furthermore, exploration (finding), development and operating (lifting) costs depend on the specific challenges of a particular resource category, and the region and reserves to be developed. The future trajectory of these costs will be affected by two opposing factors: (1) the development and use of new technologies to facilitate access to more resources and help reduce unit costs; (2) the depletion of basins that increases the effort and expense needed to extract additional resources. (IEA 2013, pp. 225–226).

The costs indicated by the IEA, divided by type, ranging from a few dollars a barrel to 30 $/barrel for conventional oils. Costs rise for conventional oils from the Middle East and North Africa (from 10 $ to 30 $/barrel approximately); other conventional oils (which can reach up to 70 $/barrel) up to arctic and ultra-deepwater oil (with an upper limit of up to 100 $/barrel).

As we can see from this small list, costs fluctuate a lot and from a historical point of view, production costs have fluctuated as the cost-increasing effects of exhaustion versus the cost-cutting effects of technological progress influence them. While evaluating aggregate production costs—i.e., not divided according to oil & gas companies—is not simple and this estimate involves non-negligible uncertainties (Aguilera 2014), it may be useful to compare the data provided by the companies with those present in the literature. For example, if we look at the graph showing the costs of oil production compared to the recoverable quantities (Aguilera 2014, Fig. 3), we observe values that range from about 25 $/barrel for "easy" oil (OPEC Middle East), up to over 120 $/barrel for Coal to Liquids (CTL) technologies. For gas (Aguilera 2014, Figs. 4, 5) things are only slightly better: they range from a value that is between 15 and 20 $/MCF (one thousand cubic feet) for conventional gas, up to over 45 $/MCF. Estimates have been made for OPEC countriesFootnote 3—now somewhat dated but still included in the period 1999–2018 analyzed—divided by low-cost E&P (exploration & production) countries (costs equal to or lower than 4.6 $/barrel), countries with average E&P cost (between 4.6 $/barrel and 8.5 $/barrel) and countries with high E&P cost (more than 8.5 $/barrel. These are too in line with the values found for individual oil companies.

source: IEA, 2013)

Upstream oil and gas investment and operating costs, by region (

To all this is added geography: production costs also depend on the region in which the fields are located. Following the IEA data (2013) we, therefore, find the following:

Other studies (e.g., McGlade and Ekins 2015; Miller and Sorrell 2014) confirm the variability of this data.

Oil Companies’ Production Costs

If we compare BP and Shell—which are among the companies that have a low, single-digit EROI—we can compare their EROI values and oil (and gas) production costs as shown in Figs. 6 and 7.

In comparison, the Norwegian Statoil/Equinor Company has very different characteristics: decidedly lower production volumes but among the highest values of EROI. (Fig. 8).Footnote 4

These graphs suggest two things:

-

1.

first of all that there is no inverse proportionality between production costs and EROI: we expect it and it is also part of our working hypothesis, which tends to separate the economic aspects from the energy ones and considers the EROI an index purely biophysical and for which the calculation methods must be of that nature.

-

2.

Secondly, if we extend the analysis to all the companies for which we have found the production costs, we see that, although there is no strict correlation between the two quantities, we are faced with two precise dynamics. The first that we could call "inversion dynamics" shows (i.e., Fig. 6) that companies with high EROI values have rather low production costs and vice versa (companies with low EROI values show high production costs). The second dynamic could be called the "dynamics of parity" for which the two values seem to go numerically hand in hand: as much is the value of the EROI as is, approximately, the cost of production (average, over the twenty years analyzed) of a barrel of oil for that company. Finally, even if 15 $/barrel as the average value of the production cost (i.e., Sinopec datum in Fig. 9, even if partially, due to incomplete data available) may seem high, it must be remembered that the average selling value of oil in the period 1999–2018 was 72 $/barrel.

These observations remain of a general nature and are in some way to be considered "crude": out of 30 companies, the values of production costs over the twenty years have been determined for only 21 of them. Of these 21, in some cases, the data are incomplete and should be taken as an estimate (see the detail in the text box of Fig. 9).

On the other hand, what can be said as an overall observation is that the EROEI, as we have seen, is remarkably constant over time. This seems to indicate that the effects of improving technology and exhaustion are effectively canceling each other out, without a clear-cut trend.

Furthermore, this result seems to suggest indirectly the “biophysical” independence of the energy resource from the fluctuations that occurred in the oil’s price along the twenty-year period under examination (and 2020, the year of Sars-CoV-19, has shown it). Using a biophysical proxy for this calculation, as is carbon dioxide, therefore seems more reliable than other proxies used by other researchers (Court and Fizaine 2017) for the EROI calculation.

The EROI of these companies seems somewhat slightly lower compared to many mean values in the literature (e.g., Hall et al. 2014). This is also true for the mean, but not the downward trend, found for private companies by Gagnon et al. (2009). How do such modest values, similar to values thought minimally required to run modern societies (Hall et al. 2009; Lambert et al. 2014) still support society? To answer this question it is necessary to resort to the concept of net energy gain (NEG) which is what society "feels" for its functioning. The relationship between EROI and NEG is known and in particular:

where ER = Energy Return and EI = Energy Investment, and

Isolating the term EI in [4] and replacing it in [5] with a few simple steps we obtain:

This relation, which is a function of the EROI, is what is actually of interest because it offers the measure of the dependence that exists between NEG and EROI, as shown in Fig. 10. What appears evident is the non-linearity of the process.

As can be seen for EROI values up to 5:1, only about 20% of the energy expended, EI, is a small fraction of the total energy produced. For an EROI = 100, EI is equal to 1% of the total, for an EROI = 20 EI is still low (equal to 5% of the total), for EROI = 10 EI rises to 10% and rapidly increases up to 100% for an EROI = 1 where the energy source ceases to be such. The worrying aspect of this story is therefore the “energy cliff” that society faces if the EROI values keep going down. The reasons for the desired energy transition are therefore two and can be considered as priorities in the same way: the first is the one just described and the second—on an equal footing—is that linked to climate change, which will only make things worse.

Finally, we can try to make a graphic comparison between the results obtained from this analysis and others present in the works cited (Fig. 11). Among these, the study that seems to have some continuity with the present work is that of Guilford et al. (2011), although there are some differences that should be borne in mind, summarized in Table 1.

Taking into account the differences shown in this table, the studies that show very high EROI values are those that have the oil and gas economy as a basis (proxy) for the calculation (Gagnon et al. 2009; Court and Fizaine 2017). Instead, the two studies that are based on a biophysical proxy—such as CO2 (this study) or data that come from government realities with indications on physical resources (and not on their price)—show much lower values.

Notes

I am indebted to Massimo Nicolazzi for information relating to the TNRR, which can be found in Nicolazzi (2019), pp. 113–114.

For the method of calculation, see the Appendix 1, in Celi et al. (2018).

Al-Attar and Alomair (2005).

Even if these are newer fields, in time their EROIs will probably fall off (Grandell, Hall and Höök, 2011).

References

Aguilera RF (2014) Production costs of global conventional and unconventional petroleum. Energy Policy 64:134–140

Albulescu CT (2020) Coronavirus and oil price crash. arXiv: https://arxiv.org/abs/2003.06184, pp. 1–13

Al-Attar A, Alomair O (2005) Evaluation of upstream petroleum agreements and exploration and production costs. OPEC Rev 29(4):243–266

Aucott M, Hall CAS (2014) Does a change in price of fuel affect GDP growth? An examination of the U.S. data from 1950–2013. Energies 7:6558–6570

Celi L et al (2018) A new approach to calculating the “Corporate” EROI. BioPhys Econ Resour Qual 3(15):1–28

Cleveland CJ et al (1984) Energy and the U.S. economy: a biophysical perspective. Science 225(4665):890–897

Court V, Fizaine F (2017) Long-term estimates of the energy-return-on-investment (EROI) of coal, oil, and gas global productions. Ecol Econ 138:145–159

Gagnon N et al (2009) A preliminary investigation of energy return on energy investment for global oil and gas production. Energies 2(3):490–503

Grandell L, Hall CAS, Höök M (2011) Energy return on investment for Norwegian oil and gas from 1991 to 2008. Sustainability 3:2050–2070

Guilford et al (2011) A new long term assessment of Energy Return on Investment (EROI) for U.S Oil and Gas Discovery and Production. Sustainability 3:1866–1887

Habib Y et al (2020) Time-frequency co-movement between COVID-19, crude oil prices, and atmospheric CO2 emissions: fresh global insights from partial and multiple coherence approach. Environ Dev Sustain 11:1–21

Hall CAS et al (2009) What is the minimum EROI that a sustainable society must have? Energies 2:25–47

Hall CAS et al (2014) EROI of different fuels and the implications for society. Energy Policy 64:141–152

Hall CAS (2017a) Energy return on investment. A unifying principle for biology, economics, and sustainability. Springer, Berlin

Hall CAS (2017b) Will EROI be the primary determinant of our economic future? The view of the natural scientist versus the economist. Joule 1:635–638

IEA (2013) Resources to Reserves 2013. Oil, Gas and Coal Technologies for the Energy Markets of the Future, International Energy Agency.

Kümmel R, Lindenberger D, Weiser F (2015) The economic power of energy and the need to integrate it with energy policy. Energy Policy 86:833–843

Lambert JG et al (2014) Energy, EROI and quality of life. Energy Policy 64:153–167

McGlade C, Ekins P (2015) The geographical distribution of fossil fuels unused when limiting global warming to 2°C. Nature 517:187–190

Melgar-Melgar RE, Hall CAS (2020) Why ecological economics needs to return to its roots: The biophysical foundation of socio-economic systems. Ecol Econ Issue C 169:1–14

Miller RG, Sorrell SR (2014) The future of oil supply. Philos Trans R Soc A 372:20130179

Murphy DJ, Hall CAS (2011) Adjusting the economy to the new energy realities of the second half of the age of oil. Ecol Model 223(1):67–71

Murphy DJ et al (2011) Order from chaos: a preliminary protocol for determining the EROI of fuels. Sustainability 3(10):1888–1907

Nicolazzi M (2019) Elogio del petrolio. Energia e disuguaglianza dal Mammut all’auto elettrica, Feltrinelli, Milano

Sers MR, Victor PA (2018) The energy-emissions trap. Ecol Econ 151:1

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Celi, L. Deriving EROI for Thirty Large Oil Companies Using the CO2 Proxy from 1999 to 2018. Biophys Econ Sust 6, 12 (2021). https://doi.org/10.1007/s41247-021-00095-6

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s41247-021-00095-6